What is a Ponzi scheme?

Financial crime has been around for ages and ages – give this article a read for an idea of what we mean [history of financial fraud]. However there has never been a more fertile time for financial crime than today. There are just so many ways for nasty criminals to try and con you out of your hard-earned cash, and we all really do need to be careful.

Here at Winzum online competitions are our main passion, but we are also staunchly dedicated to trying to keep you lovely lot as safe as possible. This got us thinking: what are some common examples of financial crime that we can try and safeguard you from? Ponzi schemes are some of the most frequently encountered types of financial crime, but what are they? Let us walk you through!

A definition of Ponzi schemes

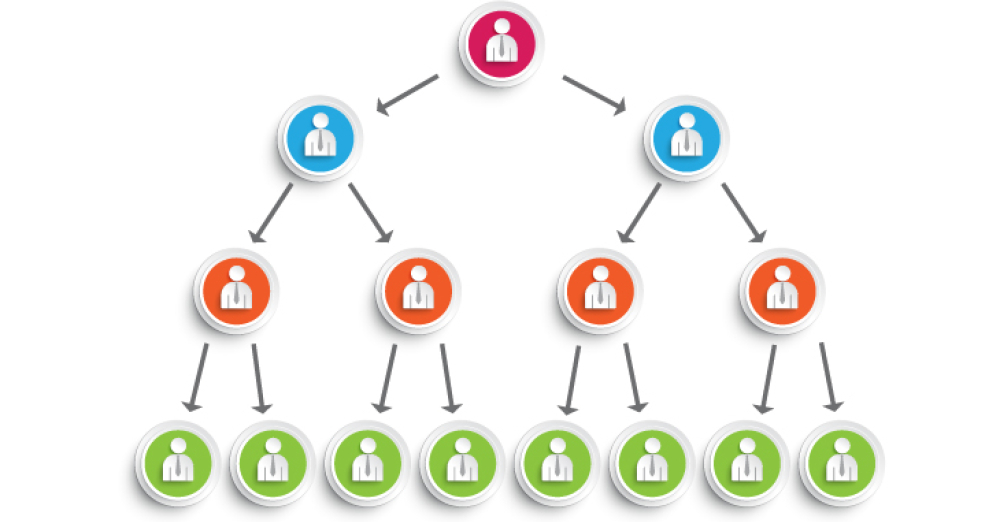

A Ponzi scheme is an example of financial investment fraud, where investors are tricked into investing their money into a business that is actually just using other investors’ money to pay profits at people towards the top of the chain. As you might be able to suss out from this, a Ponzi scheme is very similar to pyramid schemes.

A Ponzi scheme will need a consistent flood of new investors, because without it there wouldn’t be any money available to pay the earlier investors. Typically a very small number of people involved in a Ponzi scheme get any kind of financial return worth talking about, and even then they need an adequate escape plan for when it all inevitably crumbles into dust.

The history of Ponzi schemes

Ponzi schemes get their name from a high-profile American businessman called Charles Ponzi who realised he could make a 5% profit off of selling US stamps abroad back in 1919. He lured investors into his scheme with a 50% profit promise, and acquired several million dollars before he was found out.

This wasn’t the start of Ponzi schemes, however, as there is recorded examples of a similar thing going on in the mid 19th century. Charles Dickens actually wrote about this in the novels Martin Chuzzlewit and Little Dorrit, proving that Ponzi-esque financial crime was around even before the 20th century.

How to spot a Ponzi scheme

Once you know about the inner workings of a Ponzi scheme it becomes much easier to spot them in real life, as the conmen utilizing the method usually rely on a lack of knowledge around the subject. As such they are quite brazen in explaining how it works, with a lot of emphasis placed on making sure that new investors are making sure to spread the word and attract more new investors into the scheme.

Other red-flags that will help you spot a Ponzi scheme is a strange reluctance to fully disclose investment techniques and tactics, as well as a guaranteed assurance of maximum returns from minimum risks. Ponzi scheme investors can also often experience a lot of difficulties when attempting to withdraw their money – often because it doesn’t actually exist!